Small business owners already have a lot on their plate, from managing the business to bringing in prospective clients. Therefore, looking over every small detail of accounting isn’t possible.

This is where Xero makes its mark. It is a powerful accounting software that manages your finances effectively. Getting the hang of all the ins and outs of Xero takes time.

To simplify the process, we’ve compiled a list of the Top 10 Xero tips and tricks. Keep these in mind as you’re setting up your accounts or tracking your expenses, and you’ll be on your way to becoming a Xero expert!

There are times when the transactions get duplicated thereby unfairly charging your customer. This heavily affects the reputation of your Business.

But Not to Worry!

Hubdoc is here to rescue you. It is an accounting platform that is integrated with Xero to help you get more out of automating your business accounting.

With Hubdoc, you can easily erase the duplicate records found in the same document.

You can read more here.

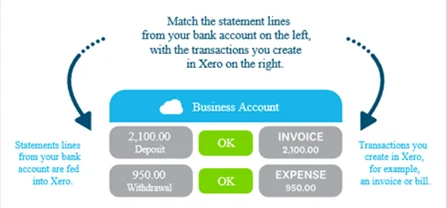

For your business to run smoothly, your bank transactions must tally with your business accounting records. Because if they don’t, it creates an opportunity for misuse of funds (siphoning).

Xero’s reconciliation feature compares your statement lines with your transactions recorded in Xero in real-time. Thereby creating a clear picture of your account statement.

The details of the reconciliation process can be found here.

When you are reconciling a transaction, accounting errors may occur. For example, you might record an overpayment by a customer and the amount may not align with the statement line. This leads to wrong entry and reconciliation would also be incorrect.

To counter this mishap, Xero also offers reverse reconciliation or unreconcile feature to remove the established link between the statement line and the transaction.

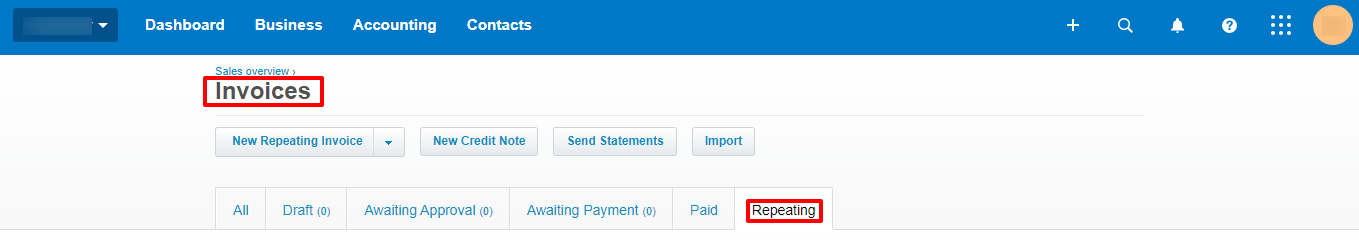

If you have customers placing recurring orders on a weekly or monthly basis, the same invoice will be created manually, again and again, which becomes tiresome.

How about you automate this process?

With the repeating invoices feature of Xero, you can create a template that holds all the details of that customer and the invoice will be created automatically.

This helps save your time and effort on recurring transactions.

To use this feature,

Xero takes care of all your accounting needs. But did you know that you can go a bit further and even automate more of your workflows?

For example, you can link your online payment system with Xero. This automatically saves all your transactions and helps you track them.

This productive and time-saving hack is possible with Integrately.

Integrately is an automation platform that helps you set up your workspace with millions of ready integrations to vastly enhance your productivity and save your time.

It provides more than 8 million ready-to-activate automations for more than 875+ applications.

8 Million+ Ready Automations

For 750+ Apps

If you don’t find your automation, you can just use the webhook feature.

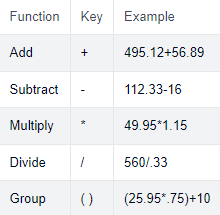

Isn’t it annoying when you have to constantly switch between your calculator and recording your invoice?

It indeed is!

It consumes a lot of time when you constantly go back and forth.

However, you can completely avoid this hassle.

With the inbuilt calculator of Xero,

Xero can streamline your calculation process with basic arithmetic functions.

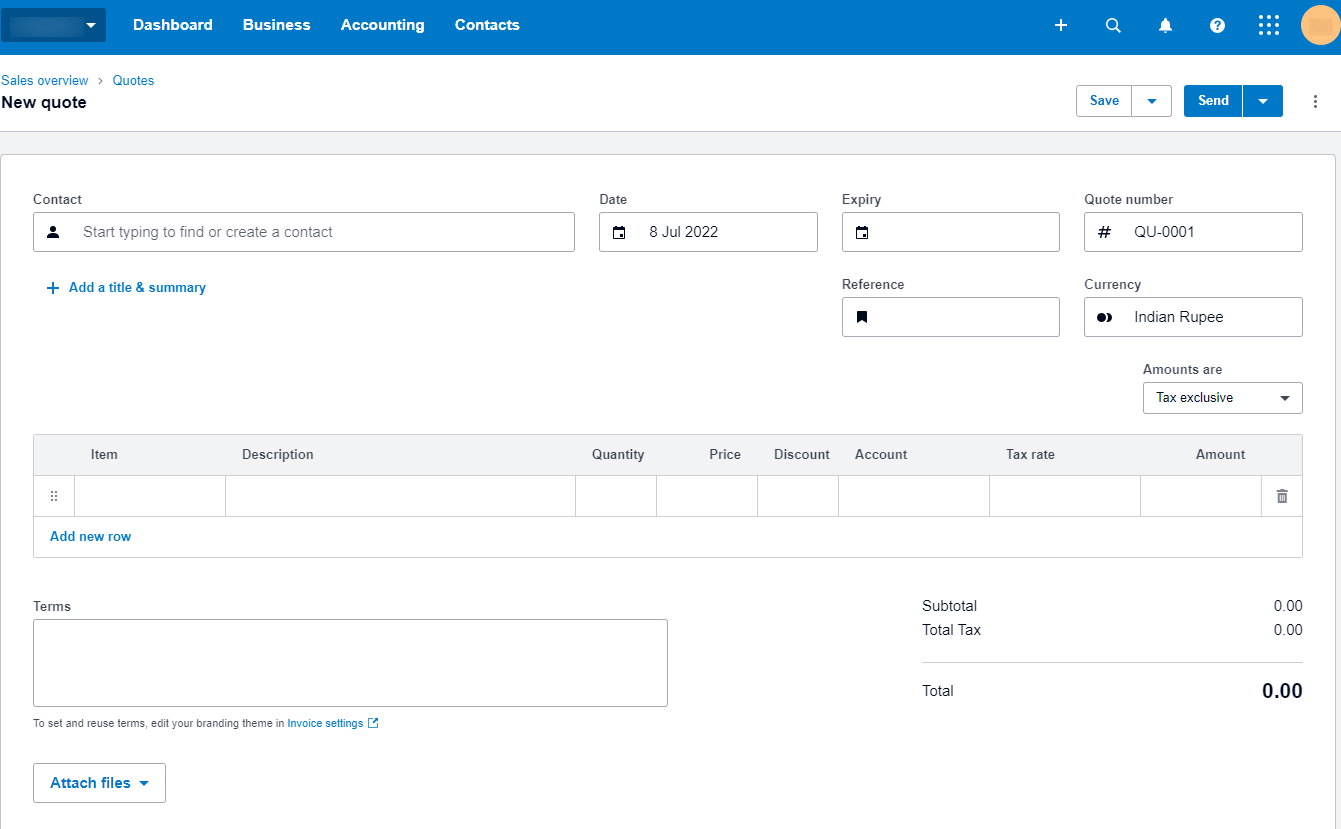

Sending quotations is important for your business as the customer will make the purchase decision based on your quoted price.

This is where the Quote feature of Xero proves its usefulness, informing them about the prices of your products/services.

The acceptance or rejection of your online quote helps you identify the customer’s intention to buy your product. You can also take a follow-up on your opened but unreplied email.

Once your quotation is accepted, you can proceed further with the invoice generation and the actual sale.

Your business performance and solvency are determined by the financial reports and ratios. They allow you to study the growth of your business by comparing the current year’s performance with the past.

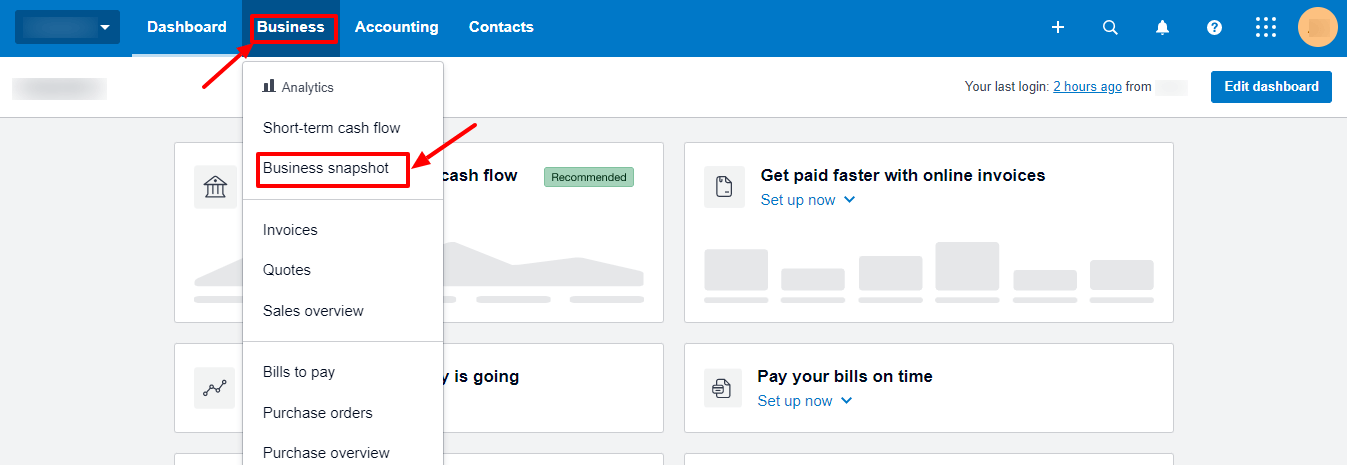

Xero’s Business Snapshot feature captures the financial position that provides performance metrics aiding you in decision making.

With the help of this feature you can:

You can also set the method of accounting that your business follows, be it On-Accrual or Cash.

To use this feature,

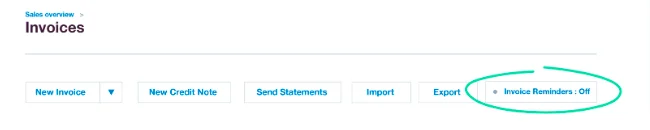

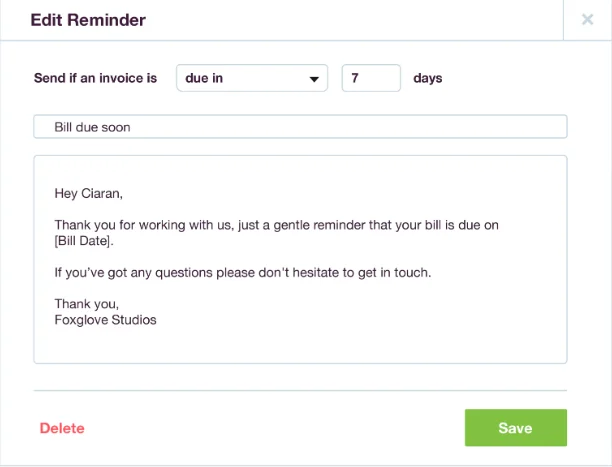

Your customers might fail to pay their dues which leads to bad debts or arrears in payments. Bad debts lead to losses thereby affecting the Goodwill and hence should be avoided at all costs.

This is where Xero comes to assist. It provides the option of setting Invoice reminders so that your customers are given timely reminders of the payments due to your business.

How does it work?

Just turn on the Invoice reminders and type in a custom message to be sent to the customer.

The message timer can also be set in the number of days before the payment is due.

Employee salaries make up for a large chunk of the fixed costs of any business. Therefore, management of the payroll system becomes essential for your business.

Xero has an inbuilt PayRun feature to manage the payroll activity of your business.

It includes:

You can read the process of managing your PayRun here.

Xero is embedded with the best features to help streamline accounting for your business. However, many features might be overlooked and hence avoided due to complex UI. But, you can keep our tips and tricks in mind to remove your doubts and complexities and get a better grip on Xero.